Abstract

Fintech has a significant contribution to enhancing the effectiveness of the financial system by lowering costs and improving service quality. Hence, several studies have been conducted to look at the direct link between Fintech Adoption (FA) and Bank Performance (BF). However, they have come up with mixed results. Therefore, the current research focuses on assessing the mediating role of Risk Management Practices (RMP) between FA and the BF in Pakistan. Primary data through a self-administered questionnaire has been used. Using a sample of 375 respondents, a positive and significant relationship between FA and BP in Pakistan has been indicated in this study. Furthermore, this relationship is significantly mediated by the RMP. The findings of the current study are helpful for the management of Pakistani Banks, academics, and the government.

Keywords

Fintech Adoption, Risk, Risk Management Practices, Performance, Commercial Banks.

Introduction

There can be no doubt about the vital role that the financial sector plays in modern society and in the lives of people everywhere (Milian, Spinola, & Carvalho, 2019). Its significance is not only for people in their daily lives but also for the global economy(Acar & Ç?tak, 2019). In today's market, financial innovation presents banks with a significant strategic challenge that must be overcome if they wish to maintain their competitive position (Zouari?Hadiji, 2023). Innovative financial technology aids in the creation of a variety of new business models to satisfy their customers and fulfill their needs and wants. Although the financial sector has been subjected to numerous significant transformation waves through the years, it has successfully adopted and survived these changes (Acar & Ç?tak, 2019).

Fintech includes financial services like mobile banking, payment transfer systems, crowdfunding, blockchain, big data analysis, and peer-to-peer lending systems, which are the outcome of a startup revolution. Fintech is also playing a crucial part in influencing consumer expectations and behavior, such as (1) having access to the data and information at any time and from any location, and (2) combining small and large firms into one so that even tiny and new businesses are held to high standards. Because of these developments in technology, a greater number of people than ever before will have access to various forms of financial services (Giudici, 2018).

The success of the banking sector is very important for the whole country, such as Pakistan. Pakistan is a developing country that views technological improvement as an important aspect of its growth and development (Saleem, 2021). In Pakistan, Fintech is still developing and steadily maintaining its position (Ali et al., 2021). At first, the main products of commercial banks in Pakistan were credit cards, debit cards, and ATMs (Automated Teller Machines) (Ali, Raza, Khamis, Puah, & Amin, 2021). Now, the growth of Fintech in Pakistani banks, like online banking, mobile banking, and electronic payments, has contributed to the country's enhanced technological productivity.

Technology has brought a revolution in the banking industry and has changed the entire way of providing services. The link between Fintech Adoption and Performance has occupied a large portion of the relevant literature. It is worth noting, however, that the majority of previous studies on this topic have yielded mixed results. While some relevant studies show a positive link between the two concepts, others do not (Gunday, Ulusoy, Kilic, & Alpkan, 2011; Zahra, Ucbasaran, & Newey, 2009). Others document that fintech adoption has a negative impact on the banking industry's performance (Zouari?Hadiji, 2023).

Despite the undeniable significance of Fintech adoption in explaining the performance of Banks, the mediating role of risk management practices (RMPs between Fintech adoption and the performance of banks in Pakistan remains unexplored for two key reasons. First, there is a lack of understanding about the factors that influence bank adoption of innovation. Second, the influence of bank innovations on financial performance is largely unknown in developing nations. In prior studies, researchers have focused on explaining risk factors, but managing risk is still in its infancy to study with respect to Fintech (Chen, You, & Chang, 2021; Gichungu & Oloko, 2015). It has been demonstrated that Fintech Adoption increases economic growth and improves the profitability of commercial banks. There has been little research performed in Pakistan to determine whether the growing, unregulated fintech sectors are having an impact on the profitability of Pakistan’s banking systems, as well as to aid in the improvement of the risk management practices.

This study aims to examine Fintech adoption on commercial banks' RMPs and performance in Pakistan. More specifically, (1) To examine the association between Fintech Adoption and RMPs of commercial Banks in Pakistan, (2) To assess the relationship between Fintech Adoption and banking Performance of Pakistan, (3) To determine the role of RMPs in mediating the relationship between Fintech adoption and the banking performance of Pakistan.

Since the global financial crisis, Fintech Adoption in the banking sector has gained significant attention and moved to the forefront of discussion. To maintain the survival and development of the banking sectors, there is a rising requirement for the adoption of Fintech to improve the RMPs as well as improve their banking performance. Pakistan's economy is under development, as was previously discussed, and the financial institutions, like the banking sector, play a very important role in the growth and development of the country. For this reason, this research attempts to contribute to the ongoing discussion about the efficiency of Fintech Adoption in developing nations, particularly in Pakistan.

The results of this study will add to the body of knowledge already available on banking performance as it relates to the effects of using fintech as the study variable. Theories such as resource-based view, dynamic capability theory, and agency theory will be given more emphasis on the relevance of financial intermediation and the need for banking sectors to be inventive and adopt financial technology to be efficient and remain competitive.

Literature Review and Hypotheses Development:

Background of the study

Researchers generate their ideas with the help of existing literature reviews and initial studies conducted on variables of interest (Ragab & Arisha, 2017). Therefore, this section intends to provide a literature review on Fintech's Adoption of RMPs and the Performance of the banking industry in Pakistan. The majority of the research conducted in the banking industry over the past two decades has focused on the development and implementation of various financial technology frameworks, as well as how these factors influence the efficiency of banks.

Worldwide Applications of Fintech

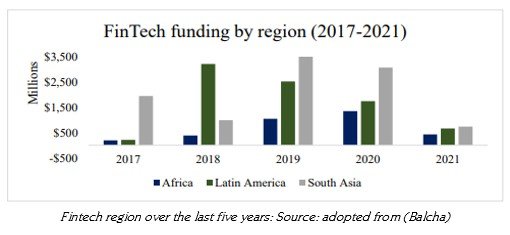

FinTech expands diversity throughout the world (Varga, 2017). International money transfers are now simpler than ever, thanks to FinTech innovation, regardless of the type of transaction (C2C or B2B). As a result, FinTech businesses receive significant venture capital funding from throughout the world to develop and deploy financial technology to improve their performance (Chen et al., 2021). International FinTech companies are seeing an increasing amount of opportunity in the world's developing economies. Over the past five years, investment in financial technology (FinTech) has risen across emerging nations, reaching a global total of USD 23 billion. The figure below shows the growth of fintech investment in three different regions (Latin America, South Asia, and Africa) over the last five years, as shown in Figure 1.

There are two basic categories of Fintech in Pakistan. The first one is traditional Fintech, and the second is emergent Fintech (Ali et al., 2021). Traditional Fintech refers to the early wave of financial technology that emerged before the rise of modern digital banking, blockchain, and AI-driven solutions. It primarily involves the application of technology to improve and automate traditional financial services such as banking, payments, lending, and investments. On the other hand, the Emerging Fintech deals with the latest advancements in financial technology that leverage cutting-edge innovations.

Recent studies on Pakistan’s financial sector emphasize that FinTech startups are playing a transformative role in driving financial innovation and inclusion. These firms not only improve access to financial services but also enhance efficiency and customer experience in the banking industry. However, challenges such as regulatory limitations, low digital literacy, and cybersecurity risks remain significant barriers to sustainable growth. Ensuring the long-term stability of the sector will therefore require supportive regulations, strong consumer trust, and the adoption of secure, technology-driven solutions. (Ahmad, 2025)

Risk Management Practices

There are some technologies adopted in the banking industry for risk management (RM), and the aim of using these technologies is to control risk. List of financial technologies specifically for the purpose of RMPs includes Artificial Intelligence, Blockchain, Big Data, ML, DL, and Robo Advisor. There are many definitions of RM in the literature discussed by different researchers. RM has been defined as "a tool for reducing, controlling, and eliminating risks, enhancing risk benefits, and avoiding potential losses from expected exposures" (Bello, 2020) and "the process of recognizing a company's loss exposures and determining the best ways to address them"(Kafidipe, Uwalomwa, Dahunsi, & Okeme, 2021). The formal method by which an organization can identify, measure, analyze, treat, and monitor potential risks is known as RM (Bauer & Ryser, 2004). A good RM system can help banks and financial organizations manage risk and improve their financial performance (Bahamid & Doh, 2017).

Figure 1

(Fintech Funding)

Banking Performance

Bank Performance refers to maximizing profits by boosting revenue and cutting costs. The Economic theory shows that profit maximization equals cost minimization in perfect competition. Therefore, banks must be assessed on effectiveness, productivity, competitiveness, and profitability as key players in financial intermediation. Ap?t?chioae (2015) has also highlighted that banking institutions are essential to the financial intermediation process. Furthermore, it is essential to evaluate the performance of banks in terms of efficiency, competitiveness, and profitability. The system of financial indicators is one of the most effective tools for assessing and presenting bank performance.

Hypothesis Development:

Fintech Adoption and RMPs

The banking institutions must establish good contingency plans and conduct an effective evaluation of their risk management systems due to the financial sector's rapid change and the variety of risks it faces (Brandon & Fernandez, 2005). Many banks lack a clear grasp of the risks posed by new products and services despite the rapid adoption of financial innovations. However, some smaller banking institutions have yet to establish adequate risk management frameworks, limiting their capacity to evaluate the risks as well as operational challenges posed by innovative financial offerings (Cappa et al., 2021). There will always be some risk involved in any investment, regardless of the type (Chen et al., 2021). Through big data, fintech can greatly assist banks in improving risk management (Gai et al., 2018). Banks can leverage data analytics to explore and analyze big data, enabling them to mitigate risks and make well-informed investment decisions with more reliable returns (Chen et al., 2021). Similarly, big data can be utilized to improve cybersecurity, spot fraud, and stop any criminal behavior (Ali et al., 2021). FinTech promotes enhanced financial innovation, profitability, and RM. Moreover, fintech can enhance traditional business models by reducing bank operational costs, improving customer service efficiency, strengthening risk management, and creating more client-centric business strategies. Many cutting-edge fintech companies have payment agreements that use blockchain technology. Operational hazards are the key areas of risk concern for blockchain applications in finance. By enabling flexible service distribution in either centralized or decentralized ways, cloud computing deployments have fueled cyber risk management.

Machine learning is another financial technology used by banks for the detection of fake currency. Cappa, Oriani, Peruffo, & McCarthy (2021) explored how big data impacts firm performance. They used RBV to support their study. They studied three dimensions of big data, namely volume, variety, and veracity, to check the impact on firm performance. They found that the volume of big data has a negative effect on firm performance. They also found that the variety of big data moderates the negative effect of volume on big data. Those findings suggested that big data can be beneficial for firm performance, so managers should contribute to a better understanding of the opportunities and challenges of big data. The existing literature shows a significant relationship between fintech adoption and RMPs. Hence, this study has the following hypothesis.

H1: There is a significant relationship between Fintech Adoption and RMPs of Banks in Pakistan.

Fintech Adoption and Performance

Several studies indicate that commercial bank performance increased after the adoption of Fintech. The adoption of Fintech helps banks boost their efficiency and profitability. There are mainly two aspects of banking profitability, namely the income side and the cost side. The increased effectiveness of core banking services like transaction and settlement, thanks to fintech's integration into more use cases, has allowed financial institutions to expand their operational horizons and revenue streams (Cappa et al., 2021). The information flow drives revenue growth in e-commerce, social networking, and other digital channels by meeting “long tail” demand through multi-point access. Commercial banks can improve their management and operations (Chen et al., 2021), as well as generate more revenue, by collecting data on their customers, employees, and competitors using fintech (Hamza, 2017). This data can be used in a variety of ways. Second, the adoption of Fintech drives the convergence of human resources, business operations, technology, and data, as well as tighter product-service integration, resulting in lower marginal service costs for banks (Chen et al., 2021). It is a widely held belief that the adoption of financial technology is frequently accompanied by high levels of uncertainty and a high probability of failure (Liu et al., 2021). As a result, the most difficult obstacle for banks to overcome in order to achieve a level of profitability that is acceptable is to effectively manage the numerous forms of risk (Stewart & Jürjens, 2018).

Fintech has almost completely transformed the commercial banks in Pakistan. Therefore, Pakistan's banking sector performance improved significantly as users gained confidence in Fintech services. Similarly, the banking sector becomes more efficient and effective through the positive influence of Fintech adoption (Paulet & Mavoori, 2019). Hence, with the help of fintech, the banking industry can offer modern ways to do business, like e-banking and mobile banking, so that people can get good services that are easy to use. Consequently, the following hypothesis has been developed:

H2: There is a significant relationship between Fintech Adoption and the Performance of banks in Pakistan.

Profitability improvements can be achieved with the help of the RM, so it is important and useful. It's important to remember that banking activities tend to involve a high degree of risk and that if those risks aren't managed well, the company's financial results could be at risk. Therefore, there has always been a lot of focus on the bank's RM efforts. The banks that have better RMPs might have certain advantages, such as (a) it boosts the bank's credibility and opens up new avenues for acquiring customers, both of which increase the bank's revenue streams. (b) It supports the compliance function in adhering to regulatory standards, and (c) it drives greater efficiency and higher profitability in banking operations. In this respect, RM is usually accompanied by improved financial performance. As a result, every business must keep and manage some degree of risk in order to increase its market value. Several studies have investigated the link between RMPs and thriving banking strategies.

Cappa et al. (2021) found that there was a strong association between RM and the performance of the banking industry of Rwanda. Shafiq & Nasr (2010) explored the current RMPs that were being followed and exercised by the banks in the context of Pakistan. Their result indicated that there was a significantly different aspect of application among the local private banks and public and commercial banks. The findings further identified liquidity risk, foreign exchange risk, credit risk, interest rate risk, and operational risk as the most critical risks facing commercial banks.

Bahamid & Doh (2017) found that practical experience and professional judgement are very important when figuring out how risky this project is. Brandon & Fernandez (2005) investigated different CRM-related parameters and their influence on the financial performance of Nepalese banks. The study included key financial metrics such as the capital adequacy ratio, cost per loan asset, and default rate. The research demonstrated that increases in the capital adequacy ratio, default rate, and cost per loan asset were associated with declines in the financial performance of Nepalese banks. Considering the facts mentioned above, effective risk management proves to be a critical factor influencing bank financial performance. Thus,

H3: RMPs mediate the relationship between Fintech adoption and the banking performance of Pakistan.

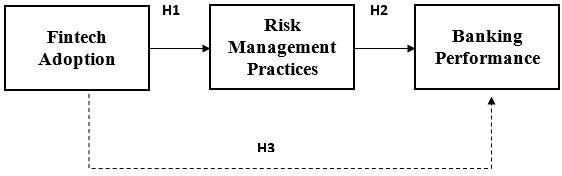

The conceptual framework of the study is presented in Figure 2.

Figure 2

Conceptual Framework

Sample and Data Collection

Convenient sampling is used to administer our survey in Faisalabad, the third largest city in Pakistan. Our respondents were branch and operational managers of the bank branches. A total of 400 self-administered questionnaires were distributed to selected commercial banks in the Faisalabad Division, Pakistan. This study has decided to collect data through an online survey and a paper-based questionnaire. A questionnaire is a low-cost method of data collection. It's a set of hard and fast written or revealed questions with multiple desired responses to which each respondent is asked to reply for the goal of a statistical examination or survey. By keeping in mind that it is feasible to contact the target respondents more effectively through a questionnaire, it is the most effective strategy to approach them within the Pakistani banking sector. The respondents are given enough time (2 weeks) to complete the surveys at their own convenience. A total of 379 questionnaires were returned out of 400 distributed. After excluding 13 incomplete responses, 366 remained usable for analysis.

Table 1 presents the Demographic Characteristics of our respondents' questionnaire items and their source.

Demographic information includes gender, age, and working experience in the banking industry. The second part of the questionnaire contains information about the study variables. Each one is measured by a 5-point Likert scale (from Strongly Disagree=1 to Strongly Agree=5). All the questionnaire items to obtain data have been adopted from different existing studies mentioned in Table 2.

Table 1

Demographic Characteristics

|

Bank Name |

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

Gender |

||||

|

Male |

232 |

63.4 |

63.4 |

63.4 |

|

Female |

134 |

36.6 |

36.6 |

100.0 |

|

Total |

366 |

100.0 |

100.0 |

|

|

Age |

||||

|

20-25 |

108 |

29.5 |

29.5 |

29.5 |

|

25-35 |

180 |

49.2 |

49.2 |

78.7 |

|

35-45 |

63 |

17.2 |

17.2 |

95.9 |

|

45& above |

15 |

4.1 |

4.1 |

100.0 |

|

Total |

366 |

100.0 |

100.0 |

|

|

Work Experience |

||||

|

0-3 |

126 |

34.4 |

34.4 |

34.4 |

|

3-5 |

127 |

23.8 |

23.8 |

58.2 |

|

5-7 |

73 |

19.9 |

19.9 |

78.1 |

|

7& above |

80 |

21.9 |

21.9 |

100.0 |

|

Total |

366 |

100.0 |

100.0 |

|

Table 2

Questionnaire Items

|

Sr no |

Section Names |

No of Items |

Source |

|

1 |

Fintech Adoption |

07 |

(Dwivedi, Alabdooli, & Dwivedi, 2021) |

|

2 |

RMPs |

10 |

(Roslan, Yusoff, & Dahan, 2017) |

|

3 |

Banking Performance |

03 |

Data Analysis Techniques

Data from the questionnaire have been analyzed using a variety of statistical techniques. The data have been described using descriptive statistics. To assess the study hypotheses, inferential statistical analysis was performed in this study. IBM SPSS (Statistical Packages for Social Sciences) 23. Zero model used to perform descriptive records, correlation, and regression analysis.

Descriptive Statistics

Descriptive records are used to arrange statistics by describing the relationship among variables in a pattern (Mondal, Swain, & Mondal, 2022). In order to generalize from samples to populations, however, another sort of statistics, known as inferential statistics, is required. Making inferential statistical comparisons must in no way take precedence over calculating descriptive statistics; that's a crucial initial step in accomplishing research. Descriptive data seek to describe the midpoint of a variety of rankings, called the degree of significant tendency, as well as the range of values known as the dispersion or variance. Describe how descriptive data encompass both measures of dispersion (along with standard deviation (SD), range, and variance) and measures of central tendency (including mean, median, and mode). Mean and general deviation are famous descriptive statistical analysis approaches used to demonstrate the critical traits of facts obtained in a study. A bigger SD price indicates that the observations in a records series are broadly spread around the mean value, whereas a smaller SD value suggests that the majority of the observations are close to the mean. Table 3 provides the descriptive statistics of the main variables involved.

Table 3

Descriptive Statistics

|

|

N |

Min |

Max |

Mean |

Sd. |

Variance |

Skewness |

Kurtosis |

||

|

Statistic |

Statistic |

Statistic |

Statistic |

Statistic |

Statistic |

Statistic |

Std. Error |

Statistic |

Std. Error |

|

|

FA |

366 |

1.71 |

5.00 |

3.9313 |

.53679 |

.288 |

-.910 |

.128 |

2.132 |

.254 |

|

RMPs |

366 |

1.70 |

5.00 |

3.9699 |

.50518 |

.255 |

-.616 |

.128 |

1.930 |

.254 |

|

BP |

366 |

1.67 |

5.00 |

4.0956 |

.57308 |

.328 |

-.604 |

.128 |

1.257 |

.254 |

Reliability & Validity

The total alpha coefficient of seven items of Fintech Adoption (0.813), the reliability score of RMPs was (0.867), and the banking performance shows (0.735) reliability scores. According to Silk, Cheney, & Seyfarth (2013), it is an extremely beneficial statistical instrument for evaluating the reliability of various variables, and its alpha value always ranges from 0 to 1 . Greater reliability is indicated by a higher ? value, and lower reliability is indicated by a lower ? value. If the reliability score is 0.7, then it is considered more reliable for various studies. The reliability score of this study also shows 0.73 or more than a high score, which is why this study is considered appropriate and reliable. Cronbach's Alpha values for each variable are listed in Table 4.

Table 4

Reliability Measures

|

Name of Variable |

No of variable items |

Cronbach Alpha |

|

Fintech Adoption (FA) |

7 |

0.813 |

|

Risk Management Practices (RMPs) |

10 |

0.867 |

|

Banking Performance (BP) |

3 |

0.73 |

Regression Analysis

A statistical procedure known as regression analysis can be used to determine the degree to which two or more variables are connected to one another. When it comes to the creation of prediction models and their subsequent evaluations, one of the most important methods that researchers have at their disposal is the examination of linear regression (Ragab & Arisha, 2017).

Results and Discussion:

Correlation Analysis

The term "correlation," which more commonly refers to the study of correlation, is used to describe the link that exists between two or more quantitative variables. It assesses the "strength" or "extent" as well as the direction of a relationship between variables. The symbol +1 (-1) denotes perfect positive "negative" correlation. In statistics, a correlation coefficient between 0.70 and 0.99 (-.70 and -.99) indicates an extremely strong positive "negative" association. The range 0.50 to 0.69 (-.70 to -.99) denotes a strong positive "negative" correlation. And, the range 0.30 to 0.49 (-.30 to -.69) denotes a moderate positive "negative" correlation. Table 5 provides a correlation among variables.

Table 5

Correlations

|

Variable |

N |

1 |

2 |

3 |

|

Fintech Adoption (FA) |

366 |

1.00 |

||

|

Risk Management Practices (RMPs) |

366 |

.669** |

1.00 |

|

|

Banking Performance (BP) |

366 |

.633** |

.646** |

1.00 |

Note: N = 366 for all correlations.

** p < .01 (two-tailed)

All of the variables in this study were found to have a positive correlation.

Key Results

The regression analysis results are indicated in Table 6 below. The R-square value is 0.45, which indicates that the adoption of fintech will result in a 45% change in RMPs. At the level of significance (P 0.00), it is also significant. As a result, the overall model is validated in light of the data. The beta coefficient shows that a one-unit change in fintech adoption will result in a change in RM procedures of 0.63-unit change. Because the p-value is below the level of significance, the regression coefficient is also significant. Therefore, we can accept hypothesis 1.

Table 6

Variable Outcome RMPS

|

MODEL SUMMARY |

||||||

|

R |

R-sq |

MSE |

F |

df1 |

df2 |

P |

|

.67 |

.45 |

.14 |

295.58 |

1.00 |

364.00 |

.00 |

|

Model |

||||||

|

|

Co-efficient |

Se |

T |

p |

LLCI |

ULCI |

|

Constant |

1.49 |

.15 |

10.27 |

.00 |

1.21 |

1.78 |

|

FA |

.63 |

.04 |

17.19 |

.00 |

.56 |

.70 |

In Table 7 below, it is shown how the adoption of fintech has affected banking performance. R-square is 0.49, which is also significant. It means that fintech adoption and risk management practices together explain 49% of the variance in banking performance. The regression coefficients for fintech adoption (? = 0.39) and risk management practices (? = 0.46) are both significant at the (P= 0.00) level. This means that for every one-unit increase in fintech adoption, there will be a 0.39-unit increase in banking performance, while a one-unit increase in risk management practices results in a 0.46-unit increase in banking performance. Hence, H2 is supported.

Table 7

Variable outcome Banking Performance

|

MODEL SUMMARY |

||||||

|

R |

R-sq |

MSE |

F |

df1 |

df2 |

P |

|

.70 |

.49 |

.17 |

174.40 |

2.00 |

363.00 |

.00 |

|

MODEL |

||||||

|

|

Co-efficient |

Se |

T |

p |

LLCI |

ULCI |

|

Constant |

.76 |

.18 |

4.20 |

.00 |

.40 |

1.11 |

|

FA |

.39 |

.05 |

7.18 |

.00 |

.28 |

.49 |

|

RMPs |

.46 |

.06 |

8.00 |

.00 |

.35 |

.57 |

Table 8 shows the mediation analysis. The results indicated that the combined model has an R-square value of 0.49, which means that fintech adoption and risk management practices together explain 49% of the variance in banking performance (p-value = 0.00). Thus, the model is significant at all stages. The ? values show 0.46 for risk management practices, which means that a one-unit change in risk management practices results in a 0.46-unit change in banking performance, and the ? value of 0.39 for fintech adoption indicates that a one-unit change in fintech adoption results in a 0.39-unit change in banking performance. The result revealed that there is a partial mediation effect of RMPs between fintech adoption and banking performance in Pakistan. Thus, we accept hypothesis 3.

Table 8

Mediation effects

|

Effect |

Coefficient |

Se |

T |

p |

LLCI |

ULCI |

|

Direct Effect (FA ? BP) |

0.39 |

0.05 |

7.18 |

0 |

0.28 |

0.49 |

|

Indirect Effect (FA ? RMPs ? BP) |

0.31 |

0.04 |

-- |

-- |

0.23 |

0.39 |

|

Total Effect |

0.7 |

0.04 |

16.82 |

0 |

0.62 |

0.78 |

|

FA ? RMPs |

0.63 |

0.04 |

17.19 |

0 |

0.56 |

0.7 |

|

RMPs ? BP |

0.46 |

0.06 |

8 |

0 |

0.35 |

0.57 |

Conclusion

Overall, the research and empirical data revealed that fintech adoption has an impact on RMPs and the banking performance of Pakistan. The findings of this study confirm that when banks adopt fintech solutions, they not only improve their risk management practices but also enhance their overall performance. The research demonstrates that FinTech paved the way for the creation of novel products and services that may improve the RMPs and efficiency of the banking sector. These results suggest that Pakistani banks are successfully using technology to transform their operations and stay competitive in the market. This research will give the banking sector a suggestion on how to coordinate technological advancements and innovations for improving the RMPs and performance of the banks.

The practical implications of these findings are important for bank managers and policymakers. Banks should not just focus on adopting new technology, but also ensure they have proper risk management systems to support these innovations. This dual approach appears to be the key to achieving better banking performance in Pakistan's developing financial market. This research, like others, has several limitations. One limitation of this research is that the survey method makes it hard to generalize and apply the results to a larger group of people. This study was done for the banking industry to find out how FinTech products affect things other than financial performance. The study population for this study was limited to commercial banks of Pakistan, whereas there are some other categories of banks that could be explored in future research to examine this relationship. Convenience sampling was used for this research. This study's limitations lie in the fact that it only touches on a number of issues related to bank fintech adoption and offers suggestions for further study in this area.

Because the current respondents are all Pakistanis, the results of this study may change if respondents from other nations participated. This study relied on primary data. An alternate approach could be used to examine the influence on banking performance using secondary data sources. Future research may investigate the effects of these technologies on organizational performance in different contexts and countries to see if similar patterns exist elsewhere.

References

-

Acar, O., & Çıtak, Y. E. (2019). Fintech Integration Process Suggestion for Banks. Procedia Computer Science, 158, 971–978. https://doi.org/10.1016/j.procs.2019.09.138

-

Ahmad, N. R. (2025, March 30). The impact of Fintech startups on financial innovation and stability in Pakistan’s evolving financial landscape. International Journal of Business and Management Sciences, 6(1), 493–505. https://ijbmsarchive.com/index.php/jbmis/article/view/825

-

Ali, M., Raza, S. A., Khamis, B., Puah, C. H., & Amin, H. (2021). How perceived risk, benefit and trust determine user Fintech adoption: a new dimension for Islamic finance. Foresight, 23(4), 403–420. https://doi.org/10.1108/FS-09-2020-0095

-

Apătăchioae, A. (2015). The Performance, Banking Risks and their Regulation. Procedia Economics and Finance, 20, 35–43. https://doi.org/10.1016/S2212-5671(15)00044-1

-

Bahamid, R. A., & Doh, S. I. (2017). A review of risk management process in construction projects of developing countries. IOP Conference Series Materials Science and Engineering, 271, 012042. https://doi.org/10.1088/1757-899x/271/1/012042

-

Bauer, W., & Ryser, M. (2004). Risk management strategies for banks. Journal of Banking & Finance, 28(2), 331–352. https://doi.org/10.1016/j.jbankfin.2002.11.001

-

Brandon, K., & Fernandez, F. A. (2005). Financial Innovation and Risk Management: An Introduction to Credit Derivatives. Journal of Applied Finance, 15(1), 52–63. http://ezproxy.library.capella.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=17908375&site=ehost-live&a

-

Cappa, F., Oriani, R., Peruffo, E., & McCarthy, I. (2021). Big Data for Creating and Capturing Value in the Digitalized Environment: Unpacking the Effects of Volume, Variety, and Veracity on Firm Performance*. Journal of Product Innovation Management, 38(1), 49–67. https://doi.org/10.1111/jpim.12545

-

Chen, X., You, X., & Chang, V. (2021). FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technological Forecasting and Social Change, 166, 120645. https://doi.org/10.1016/j.techfore.2021.120645

-

Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech Adoption for Competitiveness and Performance of the Bank: A Study of Banking Industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130–138. https://doi.org/10.1007/s42943-021-00033-9

-

Gichungu, Z. N., & Oloko, A. M. (2015). Relationship between derivatives and financial performance of commercial banks in Kenya. International Journal of Education and Research, 3(5), 443. https://www.ijern.com/journal/2015/May-2015/39.pdf

-

Giudici, P. (2018). Fintech Risk Management: A Research Challenge for Artificial Intelligence in Finance. Frontiers in Artificial Intelligence, 1. https://doi.org/10.3389/frai.2018.00001

-

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662–676. https://doi.org/10.1016/j.ijpe.2011.05.014

-

Hamza, S. M. (2017). Impact of Credit Risk Management on Bank’s Performance: Empirical Study on Commercial Banks of Pakistan. European Journal of Business and Management, 9(1), 144–152.

-

Kafidipe, A., Uwalomwa, U., Dahunsi, O., & Okeme, F. O. (2021). Corporate governance, risk management and financial performance of listed deposit money bank in Nigeria. Cogent Business & Management, 8(1). https://doi.org/10.1080/23311975.2021.1888679

-

Liu, Y., Saleem, S., Shabbir, R., Shabbir, M. S., Irshad, A., & Khan, S. (2021). The relationship between corporate social responsibility and financial performance: a moderate role of fintech technology. Environmental Science and Pollution Research, 28(16), 20174–20187. https://doi.org/10.1007/s11356-020-11822-9

-

Milian, E. Z., Spinola, M. de M., & Carvalho, M. M. de. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, 34, 100833. https://doi.org/10.1016/j.elerap.2019.100833

-

Mondal, H., Swain, S. M., & Mondal, S. (2022). How to Conduct Descriptive Statistics Online. Indian Journal of Vascular and Endovascular Surgery, 9(1), 70–76. https://doi.org/10.4103/ijves.ijves_103_21

-

Paulet, E., & Mavoori, H. (2019). Conventional banks and Fintechs: how digitization has transformed both models. Journal of Business Strategy, 41(6), 19–29. https://doi.org/10.1108/JBS-06-2019-0131

-

Ragab, M. A., & Arisha, A. (2017). Research Methodology in Business: A Starter’s Guide. Management and Organizational Studies, 5(1), 1. https://doi.org/10.5430/mos.v5n1p1

-

Roslan, A., Yusoff, N. D., & Dahan, H. M. (2017). Risk Management Support and Organizational Performance: The Role of Enterprise Risk Management as Mediator. Journal of International Business, Economics and Entrepreneurship, 2(2), 43–48. https://doi.org/10.24191/jibe.v2i2.14450

-

Saleem, A. (2021). Fintech Revolution, Perceived Risks and Fintech Adoption: Evidence from Financial Industry of Pakistan. International Journal of Multidisciplinary and Current Educational Research (IJMCER), 3(3), 191–205.

-

Shafiq, A., & Nasr, M. (2010). Risk Management Practices Followed by the Commercial Banks in Pakistan. International Review of Business Research Papers, 6(2), 308–325.

-

Silk, J., Cheney, D., & Seyfarth, R. (2013). A practical guide to the study of social relationships. Evolutionary Anthropology: Issues, News, and Reviews, 22(5), 213–225. https://doi.org/10.1002/evan.21367

-

Stewart, H., & Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information & Computer Security, 26(1), 109–128. https://doi.org/10.1108/ICS-06-2017-0039

-

Varga, D. (2017). Fintech, the new era of financial services. Vezetéstudomány / Budapest Management Review, 48(11), 22–32. http://dx.doi.org/10.14267/VEZTUD.2017.11.03

-

Zahra, S. A., Ucbasaran, D., & Newey, L. R. (2009). Social knowledge and SMEs’ innovative gains from internationalization. European Management Review, 6(2), 81–93. https://doi.org/10.1057/emr.2009.6

-

Zouari‐Hadiji, R. (2023). Financial innovation characteristics and banking performance: The mediating effect of risk management. International Journal of Finance & Economics, 28(2), 1214–1227. https://doi.org/10.1002/ijfe.2471

-

Acar, O., & Çıtak, Y. E. (2019). Fintech Integration Process Suggestion for Banks. Procedia Computer Science, 158, 971–978. https://doi.org/10.1016/j.procs.2019.09.138

-

Ahmad, N. R. (2025, March 30). The impact of Fintech startups on financial innovation and stability in Pakistan’s evolving financial landscape. International Journal of Business and Management Sciences, 6(1), 493–505. https://ijbmsarchive.com/index.php/jbmis/article/view/825

-

Ali, M., Raza, S. A., Khamis, B., Puah, C. H., & Amin, H. (2021). How perceived risk, benefit and trust determine user Fintech adoption: a new dimension for Islamic finance. Foresight, 23(4), 403–420. https://doi.org/10.1108/FS-09-2020-0095

-

Apătăchioae, A. (2015). The Performance, Banking Risks and their Regulation. Procedia Economics and Finance, 20, 35–43. https://doi.org/10.1016/S2212-5671(15)00044-1

-

Bahamid, R. A., & Doh, S. I. (2017). A review of risk management process in construction projects of developing countries. IOP Conference Series Materials Science and Engineering, 271, 012042. https://doi.org/10.1088/1757-899x/271/1/012042

-

Bauer, W., & Ryser, M. (2004). Risk management strategies for banks. Journal of Banking & Finance, 28(2), 331–352. https://doi.org/10.1016/j.jbankfin.2002.11.001

-

Brandon, K., & Fernandez, F. A. (2005). Financial Innovation and Risk Management: An Introduction to Credit Derivatives. Journal of Applied Finance, 15(1), 52–63. http://ezproxy.library.capella.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=17908375&site=ehost-live&a

-

Cappa, F., Oriani, R., Peruffo, E., & McCarthy, I. (2021). Big Data for Creating and Capturing Value in the Digitalized Environment: Unpacking the Effects of Volume, Variety, and Veracity on Firm Performance*. Journal of Product Innovation Management, 38(1), 49–67. https://doi.org/10.1111/jpim.12545

-

Chen, X., You, X., & Chang, V. (2021). FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technological Forecasting and Social Change, 166, 120645. https://doi.org/10.1016/j.techfore.2021.120645

-

Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech Adoption for Competitiveness and Performance of the Bank: A Study of Banking Industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130–138. https://doi.org/10.1007/s42943-021-00033-9

-

Gichungu, Z. N., & Oloko, A. M. (2015). Relationship between derivatives and financial performance of commercial banks in Kenya. International Journal of Education and Research, 3(5), 443. https://www.ijern.com/journal/2015/May-2015/39.pdf

-

Giudici, P. (2018). Fintech Risk Management: A Research Challenge for Artificial Intelligence in Finance. Frontiers in Artificial Intelligence, 1. https://doi.org/10.3389/frai.2018.00001

-

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662–676. https://doi.org/10.1016/j.ijpe.2011.05.014

-

Hamza, S. M. (2017). Impact of Credit Risk Management on Bank’s Performance: Empirical Study on Commercial Banks of Pakistan. European Journal of Business and Management, 9(1), 144–152.

-

Kafidipe, A., Uwalomwa, U., Dahunsi, O., & Okeme, F. O. (2021). Corporate governance, risk management and financial performance of listed deposit money bank in Nigeria. Cogent Business & Management, 8(1). https://doi.org/10.1080/23311975.2021.1888679

-

Liu, Y., Saleem, S., Shabbir, R., Shabbir, M. S., Irshad, A., & Khan, S. (2021). The relationship between corporate social responsibility and financial performance: a moderate role of fintech technology. Environmental Science and Pollution Research, 28(16), 20174–20187. https://doi.org/10.1007/s11356-020-11822-9

-

Milian, E. Z., Spinola, M. de M., & Carvalho, M. M. de. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, 34, 100833. https://doi.org/10.1016/j.elerap.2019.100833

-

Mondal, H., Swain, S. M., & Mondal, S. (2022). How to Conduct Descriptive Statistics Online. Indian Journal of Vascular and Endovascular Surgery, 9(1), 70–76. https://doi.org/10.4103/ijves.ijves_103_21

-

Paulet, E., & Mavoori, H. (2019). Conventional banks and Fintechs: how digitization has transformed both models. Journal of Business Strategy, 41(6), 19–29. https://doi.org/10.1108/JBS-06-2019-0131

-

Ragab, M. A., & Arisha, A. (2017). Research Methodology in Business: A Starter’s Guide. Management and Organizational Studies, 5(1), 1. https://doi.org/10.5430/mos.v5n1p1

-

Roslan, A., Yusoff, N. D., & Dahan, H. M. (2017). Risk Management Support and Organizational Performance: The Role of Enterprise Risk Management as Mediator. Journal of International Business, Economics and Entrepreneurship, 2(2), 43–48. https://doi.org/10.24191/jibe.v2i2.14450

-

Saleem, A. (2021). Fintech Revolution, Perceived Risks and Fintech Adoption: Evidence from Financial Industry of Pakistan. International Journal of Multidisciplinary and Current Educational Research (IJMCER), 3(3), 191–205.

-

Shafiq, A., & Nasr, M. (2010). Risk Management Practices Followed by the Commercial Banks in Pakistan. International Review of Business Research Papers, 6(2), 308–325.

-

Silk, J., Cheney, D., & Seyfarth, R. (2013). A practical guide to the study of social relationships. Evolutionary Anthropology: Issues, News, and Reviews, 22(5), 213–225. https://doi.org/10.1002/evan.21367

-

Stewart, H., & Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information & Computer Security, 26(1), 109–128. https://doi.org/10.1108/ICS-06-2017-0039

-

Varga, D. (2017). Fintech, the new era of financial services. Vezetéstudomány / Budapest Management Review, 48(11), 22–32. http://dx.doi.org/10.14267/VEZTUD.2017.11.03

-

Zahra, S. A., Ucbasaran, D., & Newey, L. R. (2009). Social knowledge and SMEs’ innovative gains from internationalization. European Management Review, 6(2), 81–93. https://doi.org/10.1057/emr.2009.6

-

Zouari‐Hadiji, R. (2023). Financial innovation characteristics and banking performance: The mediating effect of risk management. International Journal of Finance & Economics, 28(2), 1214–1227. https://doi.org/10.1002/ijfe.2471

Cite this article

-

APA : Zahra, M., Anees, F., & Ishtiaq, M. (2025). Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices. Global Management Sciences Review, X(III), 44-54. https://doi.org/10.31703/gmsr.2025(X-III).05

-

CHICAGO : Zahra, Mustajab, Faisal Anees, and Muhammad Ishtiaq. 2025. "Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices." Global Management Sciences Review, X (III): 44-54 doi: 10.31703/gmsr.2025(X-III).05

-

HARVARD : ZAHRA, M., ANEES, F. & ISHTIAQ, M. 2025. Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices. Global Management Sciences Review, X, 44-54.

-

MHRA : Zahra, Mustajab, Faisal Anees, and Muhammad Ishtiaq. 2025. "Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices." Global Management Sciences Review, X: 44-54

-

MLA : Zahra, Mustajab, Faisal Anees, and Muhammad Ishtiaq. "Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices." Global Management Sciences Review, X.III (2025): 44-54 Print.

-

OXFORD : Zahra, Mustajab, Anees, Faisal, and Ishtiaq, Muhammad (2025), "Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices", Global Management Sciences Review, X (III), 44-54

-

TURABIAN : Zahra, Mustajab, Faisal Anees, and Muhammad Ishtiaq. "Fintech Adoption and Bank Performance in Pakistan: Mediating Role of Risk Management Practices." Global Management Sciences Review X, no. III (2025): 44-54. https://doi.org/10.31703/gmsr.2025(X-III).05